Better purchases Birmingham Bank to enhance its UK Platform

- Global digital home ownership platform, Better, completes acquisition of Birmingham Bank.

- Creation of 40 jobs anticipated at Birmingham Bank over the next three years, across a range of specialist roles.

- Acquisition to support Better’s focus on increasing homeownership by scaling residential mortgage lending across the U.K.

Better, the global digital home ownership platform, today announces the completion of its acquisition of Birmingham Bank in the United Kingdom. Birmingham Bank, established in 1955, has an historic customer focus primarily in the Midlands.

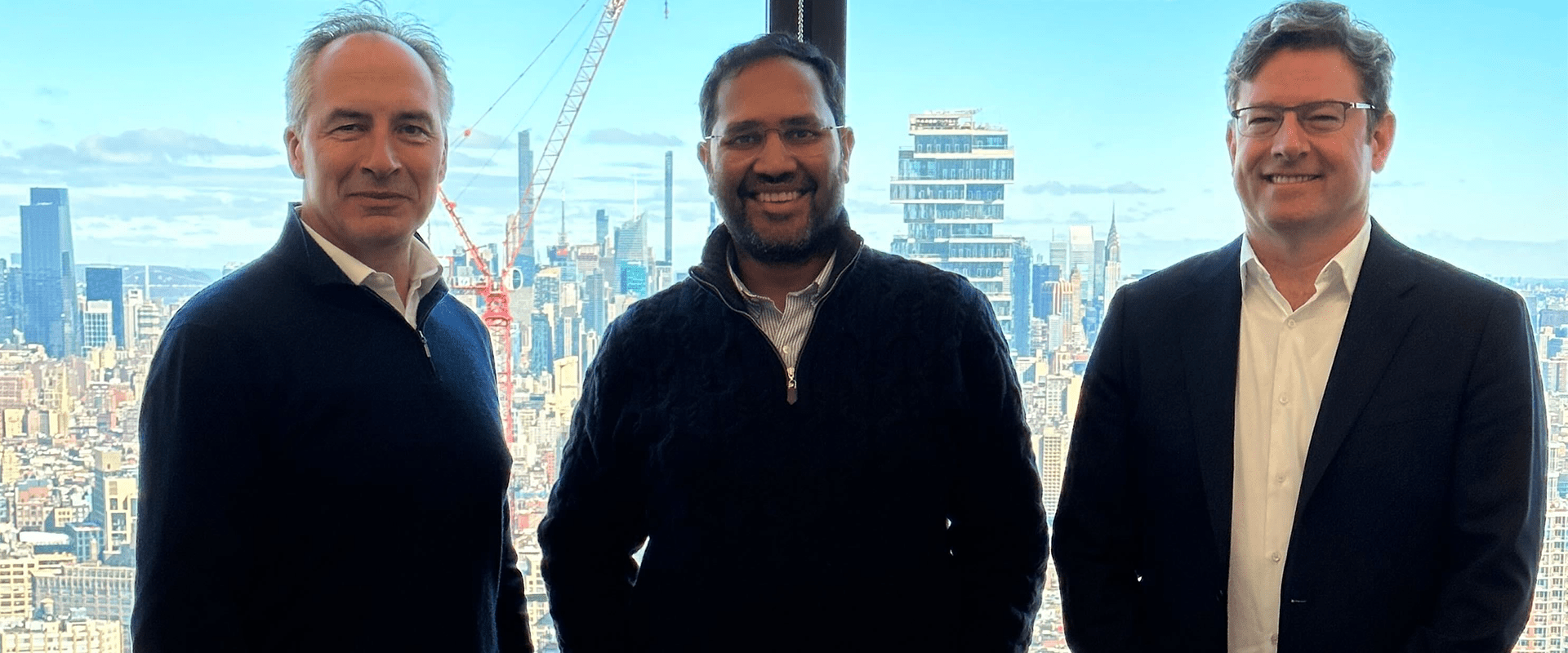

Vishal Garg, Founder and CEO of Better, said:

“Better’s global mission is to make homeownership cheaper, faster, easier and simply much better for all. We are excited to bring Birmingham Bank into the Better family and look forward to helping it grow its exposure to residential lending business across the United Kingdom. Along with our United Kingdom mortgage advisor Better.co.uk and our United Kingdom mortgage lender Better HomeOwnership we have positioned Better to deliver a vertically integrated platform to help consumers across the market achieve their home ownership dreams.”

In 2022, Better purchased a minority interest in Birmingham Bank. After approval as controlling parties by the Prudential Regulation Authority of Better and Vishal Garg, Better has now purchased all remaining shares of Birmingham Bank. The Bank’s amended strategy will see it assist Better’s plan to scale residential mortgage lending across the U.K. over the coming years, with the Bank growing its consumer and SME deposit base. This will in turn will fund Better HomeOwnership loans via forward flow agreements.

CEO of Birmingham Bank Matt Smith, said:

“Better’s acquisition of the Bank will bring to life our strategy and deliver a compelling proposition and service. We look forward to supporting our loyal customer base by continuing to offer our deposit and SME finance product ranges and welcoming many new customers in the coming months and years.”

Better’s acquisition is anticipated to create 40 jobs within the Bank in the next three years in roles across business development, savings management, marketing, operations, finance, risk management and IT.

Andy Street, Mayor of the West Midlands, commented:

“This investment reinforces the West Midlands’ strong track record of attracting US investment and Better will be an extremely valuable addition to what is the UK’s largest regional financial and professional services cluster.”

“With an established history in the city, we’re also very proud that Birmingham Bank will keep its original name as it helps future generations of local people to get onto the housing ladder.”

Michael Lamont, Better Vice President for Europe, who will join the board of Birmingham Bank subject to regulatory approval, said:

“We are delighted with the support to date from public and private sector leaders across Birmingham and the West Midlands and look forward to collaborating with them in the coming years. Better is committed to maintaining Birmingham Bank’s local lending presence and helping families across the United Kingdom benefit from Better’s mission to make homeownership cheaper, faster and easier, underpinned by always lending responsibly.”